You want to get out of debt but are not sure where to start. Can you afford to pay off debt on your own or should you consider more formal options? Our guide to debt elimination explains how to assess your current debt situation and create a debt reduction plan that is right for you. Debt problems are scary. You don’t know what to do or where to turn. Even worse, it’s embarrassing. You don’t want to talk to your friends or family about your credit problems. You may even be afraid to lose your credit cards because credit is what is helping you get by right now. We also know it’s not easy to eliminate debt accumulated over a long time. That’s why we’ve created this guide on How to Eliminate Debt.

DOWNLOADS

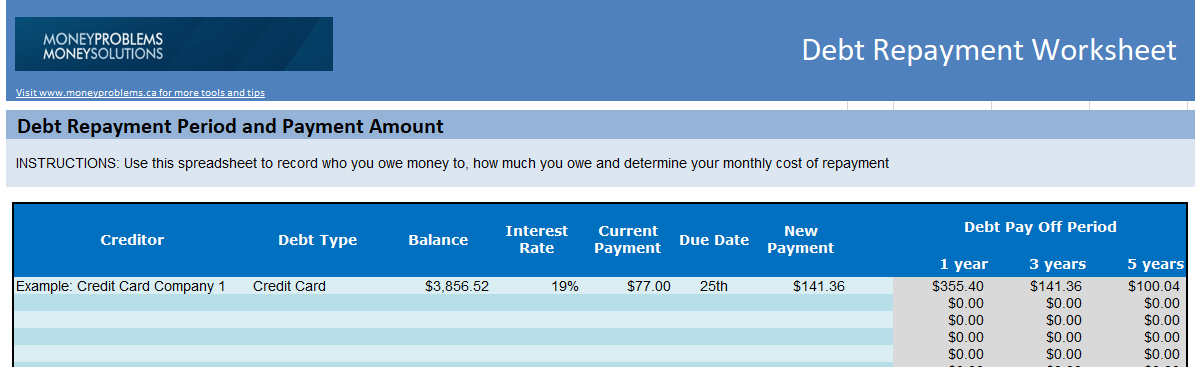

Excel Debt Repayment Worksheet Google Docs Debt Repayment Worksheet

Assessing Your Debt Situation

No matter the solution, the starting point is to assess your current financial situation so you can create a debt reduction plan that works for you.

List your debts

Taking stock is quite simple. Get yourself a file folder or a bulletin board, or use the kitchen table. Then, find the most recent statement from everyone you owe. That means all your credit card statements, bank loans, car loans, mortgages, and even family loans.

Download our Debt Repayment Worksheet to record your debts in an excel spreadsheet. List each creditor, the type of debt, the interest rate you are paying, and the amount you owe.

Be honest. Include everyone, no matter how small. There is no point in deceiving yourself. Even if it’s a small amount, a debt to a family member, or a “don’t pay for a year” debt from a furniture store, include it. Are you shocked by the amount of money you owe? Most people with money problems have no idea how much they owe, so completing the Debt Worksheet is an eye-opener. The good news: now that you know how much you owe, you can start taking steps toward debt recovery.

Can You Budget your Way out of Debt?

The most obvious place to start paying off debt is on your own. Look at your budget to see if you can repay your debts on your own in a reasonable timeline or if you will need to explore other options. Skip over to our budgeting section and download our Excel Budgeting Spreadsheet. Follow the step-by-step instructions on how to create a budget. Or simply:

- Total up all your monthly expenses

- Subtract your monthly costs from your total income

- Figure out how much money you can afford to apply to your debt.

Go back to the debt repayment worksheet and look at what your payments will need to be to pay off your debt in one year, three years, or five years.

- Do you have enough available cash flow to pay off your non-mortgage debt within say five years?

- Can you cut back on enough personal and living expenses to make this work?

If so, make a repayment plan that focuses on paying down those debts as fast as you can. If you have money left over at the end of the month, use that money to make extra payments on your debts to pay them off faster. Read more on additional strategies to help you pay off credit card debt. Start with your highest interest debt first, always making the minimum payment on all your other debts. Use the avalanche method of debt repayment. Once one debt is paid off, apply that payment towards another debt. The more money you put towards debt repayment early, the less you will pay in interest, and the sooner you will be out of debt.

How bad is your debt-to-income ratio?

Even if you’re making your monthly payments, you might still have a dangerous amount of debt. Your debt-to-income ratio measures how much flexibility you have to keep up with debt payments in the event of a reduction in your household income. Use our online debt-to-income calculator to measure your own risk level.

- A ratio of 30% or less is good. Most lenders consider a ratio of 36% or less a healthy debt load; however, we feel a ratio of 30% or lower is a better target. If you are in this range, you can probably build a budget and create a repayment plan that you can stick with, even with a small hiccup in your income or expenses.

- 31-42% is manageable, but you are at the maximum range of what could be considered an affordable level of debt payments. If interest rates on your line of credit increase or you continue to use credit, your debt payments become unaffordable. If you are in this range, make an aggressive plan to reduce your debt faster or talk to a professional about options that can help you get out of debt.

- 50% or more. If your monthly debt payments are consuming 50% or higher of your paycheque you are at high risk of eventually missing payments. You will eventually find that you have too much debt to qualify for more credit. If you are in this range, paying your debts off on your own as they are today may not be feasible. It’s time to explore other options like those we explain below.

Do you have high-interest debts?

If you have high-cost credit card debts or financing loans, you can try to balance your budget with a lower-cost debt consolidation loan.

Consolidate Your Debts

A debt consolidation loan can be the solution to your money problems, but only if you qualify and can afford the payments.

Can a debt consolidation loan reduce your debt?

By itself, traditional debt consolidation does not eliminate your debt. You are simply trading new debt for an old debt. A debt consolidation loan is a personal loan that allows you to pay off multiple existing credit cards, for example, with the proceeds from a single new consolidation loan. Instead of several payments, you make one monthly payment to your consolidation lender. You can get out of debt faster with a debt consolidation loan assuming you qualify for a lower interest rate than what you are paying on your current debts. A lower interest rate means a greater portion of your payment is going to the principal and less towards interest. Converting credit card debts that charge 29%, or a financing loan that bears an interest rate of 49%, into even a relatively high-cost consolidation loan at 12% or 14% will help you get out of debt sooner. Qualifying for a debt consolidation loan and paying it off can improve your credit rating, which may lower your borrowing costs in the future.

Can you afford your debt consolidation payments?

Another benefit people look for when seeking a consolidation loan is a reduction in their total monthly payment. The longer the term of your loan, the lower your monthly payment will be. This is both good and bad for your finances. A lower monthly payment is more affordable and will help you balance your budget. However, the longer the term, the more you pay in interest and the longer you remain in debt.

Do I qualify for a debt consolidation loan?

To qualify for a debt consolidation loan, you must meet the minimum credit score requirements for the type of loan you are borrowing, earn enough so that your monthly minimum payments are not too high relative to your income, and, if you are applying for a secured loan like a second mortgage, have sufficient collateral to satisfy the lender’s requirements. Banks calculate your ability to service a debt based on your income. Be prepared to show the bank your most recent pay stubs and last year’s tax return when you apply for a debt consolidation loan. If you have variable or contract income, you may find it necessary to refinance through a non-traditional lender.

Should I get a co-signer?

If you have poor credit or missed or late payments, it may be difficult to qualify for a loan. You may need a co-signor or collateral, such as a car or a house, to get the loan. If a friend or family member agrees to co-sign for you, they are now fully responsible for your loan. If you don’t make the payments, the bank will pursue your co-signer for payment. Only ask a friend or family member to co-sign on your behalf if you are absolutely certain that you can make all of the payments. If you are afraid that you may miss a payment, do not get a co-signer.

What do I do if the Bank says “No”?

There is no guarantee that you will qualify for a debt consolidation loan. If you are rejected for a loan, here are the steps you should take:

- Ask the bank why you were declined. It may be that you are close to qualifying. If you can reduce your debt or increase your income, you may be able to re-apply again in six months or a year. Don’t be tempted to reapply too early. Each time you apply for a loan, a note appears on your credit report. Too many hard hits lower your credit score.

- If your bank doesn’t approve your second mortgage, consider talking to a mortgage broker. They have access to many different lenders, so they may be able to get you a mortgage even when the bank says “no.”

- You can consider applying for a low-credit consolidation loan; however, be aware that these types of loans come with a much higher interest rate.

If a consolidation loan will not deal with all your debts, or you don’t qualify, you may want to consider working with a credit counselling agency.

Credit Counselling – Debt Management Plan

Credit counselling agencies help you repay the debt through a program called a debt management plan (DMP) or debt consolidation program (DCP). The name doesn’t matter; the program works the same.

What is a debt management plan?

A debt management plan through a credit counsellor is a payment plan that will help you pay off all your debt over a set amount of time. The maximum repayment period allowed under the program is five years. You can choose which debts you would like to include in your consolidation program, including credit card debts, unpaid bills, and financing loans. At the same time, individual creditors can opt in or opt out of the program. Some payday loan companies will participate in a debt consolidation program; others will not. Some debts do not qualify for a debt management plan including government student loans and tax debts. With a debt management plan, you pay off all your debt, but in most cases, your credit counsellor can negotiate a reduced or even zero rate of interest.

How do I make a debt management plan?

To make a debt management plan, you will meet with a credit counsellor who will help you figure out if you are eligible or not. He, or she, will ask you how much money you owe, who you owe money to, what your expenses are, and how much money you make. They will use this information to set your monthly payment and time of repayment. Remember, all plans must finish within five years. For example, if you owe $23,000, you can repay this over five years for a monthly payment of $422 a monthly, including the credit counsellor’s fees of 10%. Once you sign up for a debt management plan, your counsellor will contact the creditors in your plan to see if they will participate in the repayment plan.

What happens after my debt management plan is approved?

You will make one monthly payment to the credit counselling agency, which will then forward the money to creditors who agree to participate. Creditors may freeze interest during the program.

Will a debt management plan work for me?

A debt management plan is a great solution if you can afford to pay your debts in full over two to five years. A debt management plan will remain on your credit report for 2 to 3 years from the date the program was satisfied or six years after you defaulted (usually the date you filed), whichever comes sooner. But what can you do if you can only afford to repay half of your debts over the next few years? Credit counsellors cannot help you settle your debt for less than you owe. An option to formally settle your debts can only be done through a Licensed Insolvency Trustee and a program called a Consumer Proposal.

Consumer Proposal – Settle Your Debts

Do you have more debt than you can handle? Do you have a job, and you want to make payments, but you can’t afford to repay the full amount your creditors want each month? Are you afraid that bankruptcy may be your only option? A consumer proposal is a legal procedure available to people living in Canada that are experiencing financial difficulties but can still afford to repay a portion of their debts. A consumer proposal is an alternative to filing bankruptcy, which means not just anyone can use a consumer proposal to get rid of their debts. To file a consumer proposal, you must be insolvent, which means you have more debts than assets, or your income is not high enough to keep up with your debt payments any longer.

What is a consumer proposal?

Essentially a consumer proposal is an offer to repay part of what you owe. It is called a proposal because you are “proposing” a deal to your creditors. Your creditors must agree to your proposal for it to work.

How do I file a consumer proposal?

To file a consumer proposal, you need to see a Licensed Insolvency Trustee, who will act in the role of proposal administrator. Your trustee will first complete what is called a debt assessment. The purpose of the assessment is to review your situation to determine if filing a consumer proposal is right for you. Your proposal administrator will conduct a full debt assessment and review several different options with you before suggesting you proceed with a consumer proposal.

How does a consumer proposal affect my debt repayment?

Once your proposal is signed, you stop making payments. Beware of working with an unlicensed debt consultant who suggests you stop making payments before your consumer proposal is legally filed with the government. A consumer proposal has the legal power to stop collection actions. Stopping payments without this protection will increase collection calls and could result in wage garnishment. Once your proposal is filed, your trustee will notify the creditors of your terms. Each creditor can file a claim and vote to accept or reject your proposal. If the majority of your creditors agree, the proposal is binding on all your creditors. A consumer proposal will remain on your credit report for 2 to 3 from the date the program was satisfied or six years from the date you filed, whichever comes sooner. Consumer proposals – a creative solution Consumer proposals can have different terms to suit your needs. There are a few basic rules that must be followed, regardless of the proposal you make:

- You must offer your creditors more money or a greater benefit than they would receive if you went bankrupt. This makes sense – why would your creditors accept your deal if it is for less money than a bankruptcy?

- You must be able to make the payments you are proposing. Again, this is pretty straightforward – there is no point in offering your creditors a payment plan you know you can’t maintain.

- Each creditor also has its own set of rules for accepting (or rejecting) a consumer proposal. Trustees that handle a large number of proposals will have a good idea of what those rules are. Your trustee should be able to warn you if any of your creditors require unusual terms or may ask for more than you have offered.

In general, however, it is possible to settle your debts for less than you owe and you can save up to 70% of your total outstanding debts.

The Last Resort: Personal Bankruptcy

If all else fails, personal bankruptcy is the last option for dealing with your overwhelming debt problems. No one wants to go bankrupt, and most Canadians do everything they can to avoid it. But for some, it truly is the only logical solution. In this option, a trustee is appointed to administer your affairs. You make payments based on your income, and you may lose some of your assets. At the end of this period, your unsecured debts are resolved in full. Most bankruptcies last nine months but can be longer if you have a high income. Bankruptcy is a last resort and should only be considered if all other options have failed.

Choosing the Right Debt Relief Solution

Almost everyone has some form of debt – whether it’s a mortgage, car loan, student loan, or credit card debt. But are these serious debt problems? When should you seek debt help? You might think you have typical money problems, but they can become much more serious if you don’t address them. By recognizing your problems right away, you can start on the path to finding a solution. 10 Warning Signs of Debt Problems

- Are you making only minimum payments on your credit cards?

- Do you find it difficult to pay monthly bills regularly and on time?

- Do you use overdraft often?

- Are you using credit because you don’t have money for everyday expenses?

- Are you unsure of how much you owe?

- Do arguments about money cause problems with loved ones?

- Are you charging more than you repay each month on credit?

- Are you over your borrowing limit on your credit cards, overdraft, or line of credit?

- Are collection agencies calling you?

- Has anyone initiated legal action against you?

If you answered “yes” to any of these questions, you might have debt problems.

- Find out what your monthly payment options might be using our debt options calculator

- Contact a professional for advice on how you can eliminate your debt, reduce stress, and get a fresh start. Contact an advisor for a free evaluation

Consumer Proposal: Government Debt Relief

If your debts and bills are too much to handle but you want to avoid bankruptcy a consumer proposal may be an appropriate alternative for you. A Canada consumer proposal is a legal debt settlement option legislated by the federal... Read more » Read More

Bankruptcy : The Last Resort But Here is When it Works

While no-one wants to file personal bankruptcy, ultimately, it can be the necessary bridge between continuing to drown in payments and getting out of debt. In this article, we explain everything you need to know to decide whether you’re at... Read more » Read More

Could a Debt Management Plan be Right for You?

If you are struggling to regain control of your debt, you might benefit from considering a debt management plan (DMP). But, what exactly is a debt management plan and is it right for you? In this article, we round up... Read more » Read More

Pay Off Credit Card Debt with these Simple Strategies

When used properly, credit cards can be a helpful means of managing payments for everyday expenses. If you keep your balances low and your payments regular, they can help you to build a better credit score, making access to better... Read more » Read More

Debt Consolidation Loans - Choose the Right Type of Loan

If you find yourself juggling multiple payments to different lenders, or struggling to meet your minimum payments each month, it might be time to consider consolidating your debts. This article covers the types of debt consolidation loans commonly available in... Read more » Read More

8 Warning Signs you have a Debt Problem

The thing about debt is that it creeps up on you. There is rarely a lightbulb moment where you realize that you have a debt problem. Usually, it happens gradually, and by the time you acknowledge the issue, it can... Read more » Read More